We would like to set up a company in Malaysia with 100 shareholder will be a singapore registered company 1 foreigner director and 1 local malaysian director carry out IT consultancy business in Malaysia. These new Guidelines which are yet to be fully implemented drag nominee shareholder structures which are not uncommon in Malaysia into the spotlight.

Business Setup In Bangladesh Full Procedure Business Garments Business Bangladesh

Other Malaysian companies as listed in their Memoranda Articles or governed by Ministry guidelines.

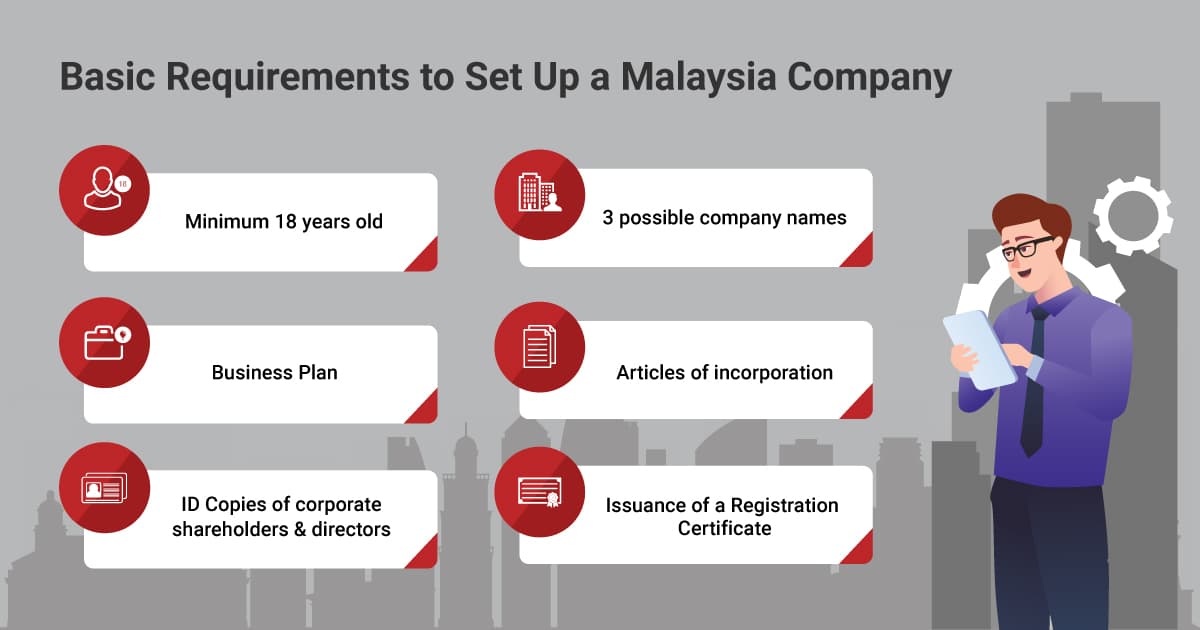

. Company tax rate may be lower than a foreigners personal income tax rate depending on the individuals tax residency status. Propose 3 names and search to confirm availability. Below are some steps involved when we assist you to get started on incorporating Malaysian Company Sdn Bhd.

I decided to go ahead to register Malaysia Sdn Bhd company what are the next steps. Once the name is approved it will be reserved for 30 days from the date of approval. One resident director is required.

FOREIGN shareholding of Malaysian equities has encountered a slide since the 14 th General Election GE14 falling to 204 as of end-February or just 01 percentage point shy of the previous low of 203 in May 2010. You need to have a private limited company example. Local insurance companies and Takaful operators.

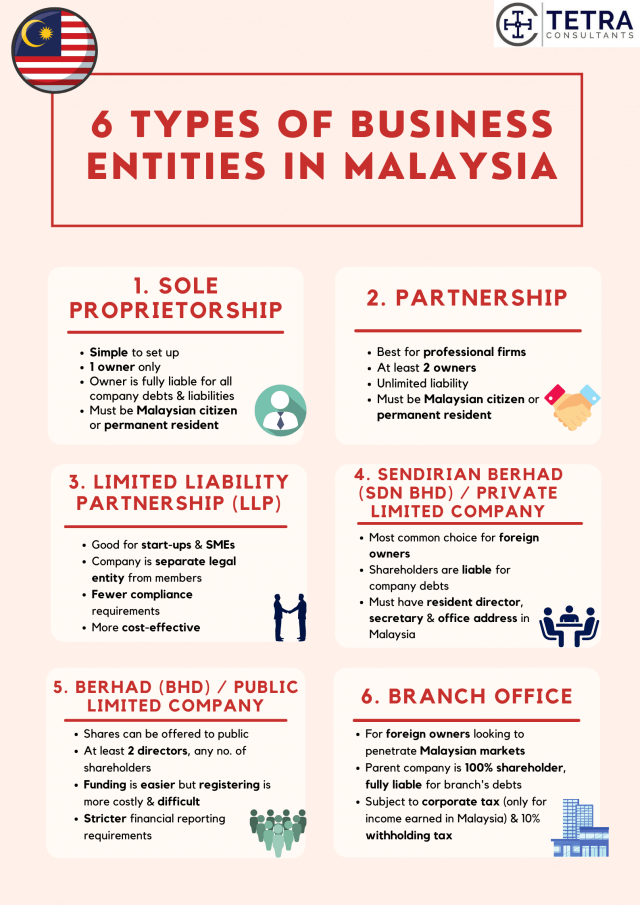

Subsidiary companies require a minimum of one corporate shareholder or can be a corporate that is either 100 local or 100 foreign-owned. And a minimum of MYR 350000 MYR 1 million paid-up capital is a must. Establishing a private limited company locally known as a Sendirian Berhad Sdn Bhd is the most common type of business entity in Malaysia for foreign investors.

The company name should be submitted through the Companies Commission of Malaysia online system with a fee of RM 50. Foreign director can not apply for work permit to live in Malaysia unless investment capital of the company is Ringgit 500000-. In general the foreign ownership limits FOL on shareholding in Malaysian companies are as follows.

Contact with us for consultation over WhatsApp. Tracking the decline CGS-CIMB Research observed that this started in May 2018 soon after GE14 or after the GE14 on May 9 2018. An RPC is a company that owns real property in Malaysia or shares in other RPCs to the.

In order to have complete foreign ownership the company must be in specific industries as dictated by the government. Application to Register A Foreign Company in Malaysia a Within 30 days from the date of company name approval the applicant may submit the following information to SSM. Effective from 2018 Year Assessment the following corporate taxation rate applies to all Malaysian Sdn Bhd companies.

Joint venture minimum foreign equity is 30 shareholding in the company. A foreigner can register a corporation in Malaysia with 100 foreign ownership. We are committed to building long-term relationships based on fair and timely disclosure transparency openness and constructive communication.

Malaysias economy has been thriving over the last. The subsidiary company name does not need to be the same as the foreign parent company and must register the company with the Companies Committee of Malaysia. It is also dependent on shareholding structure nature of the business and.

Regardless of where a holding company is incorporated it is considered a tax-resident in Malaysia if it is managed and controlled in Malaysia. Yes you can run a business in Malaysia and the company can be 100 foreign owned. There is at least one foreign director is needed to register Sdn Bhd company.

Bursa Malaysia Bhds foreign shareholding slipped to 144 in January the lowest on record according to the latest updates on the bourse regulator and operators website on Tuesday Feb 8The foreign shareholding stood at 145 in December 2021Bursas foreign shareholding has been on a declining trend since April 2021 when it. KUALA LUMPUR Feb 8. We will define on your business nature and activities to match your objective in Malaysia including profiling ready for licenses and visa application.

100 foreign owned. Discuss and define the scope of business activities if you can have a 100 foreign owned company. I the name identification nationality and the ordinary place of.

Decide your shareholding structure with minimum one Shareholder. The maximum personal income tax rate in Malaysia for a non-resident is a flat rate of 30 while the corporate tax rate in Malaysia starts at 17 for the first RM 600000 per year and 24 in excess of that. Our service fee is RM2048.

For all non-resident status Sdn Bhd companies for eg. Taxation for Foreign-Owned Sdn Bhd Company in Malaysia. The following are a few of the industries in which the Malaysian government is trying to encourage foreign investment.

Net taxable rate for profits 24. Foreign companies commonly set up Malaysian-resident holding companies to acquire shares or assets in Malaysia. It has always been Bursa Malaysias priority to demonstrate the highest standards of integrity to our shareholders and the investment community.

The entity offers a host of benefits such as being able to be 100 percent foreign-owned and being relatively quick to setup. Foreign-owned companies operating in wholesale retail and trade restaurant. 100 local owned.

Domestic investment banks and domestic Islamic banks. If you want to extend the period of name reservation you will have to pay a fee of RM 50 for every 30 days. Such restrictions are imposed on certain.

This is called a Sdn Bhd. Companies with more than 50 foreign shareholders the effective tax rates. Such nominee shareholder structures are sometimes used to meet ownership requirements under the Malaysian restrictions on foreign direct investments.

ABC Sdn Bhd Company paid up capital requirement. Name your directors and shareholders. To setup a 100 foreign owned company in Malaysia all kinds of businesses are permitted.

In certain industries the Government encourages foreign investment.

Setting Up A Company In Malaysia A Foreigner S Guide Singaporelegaladvice Com

Company Registration Malaysia Company Malaysia Registration

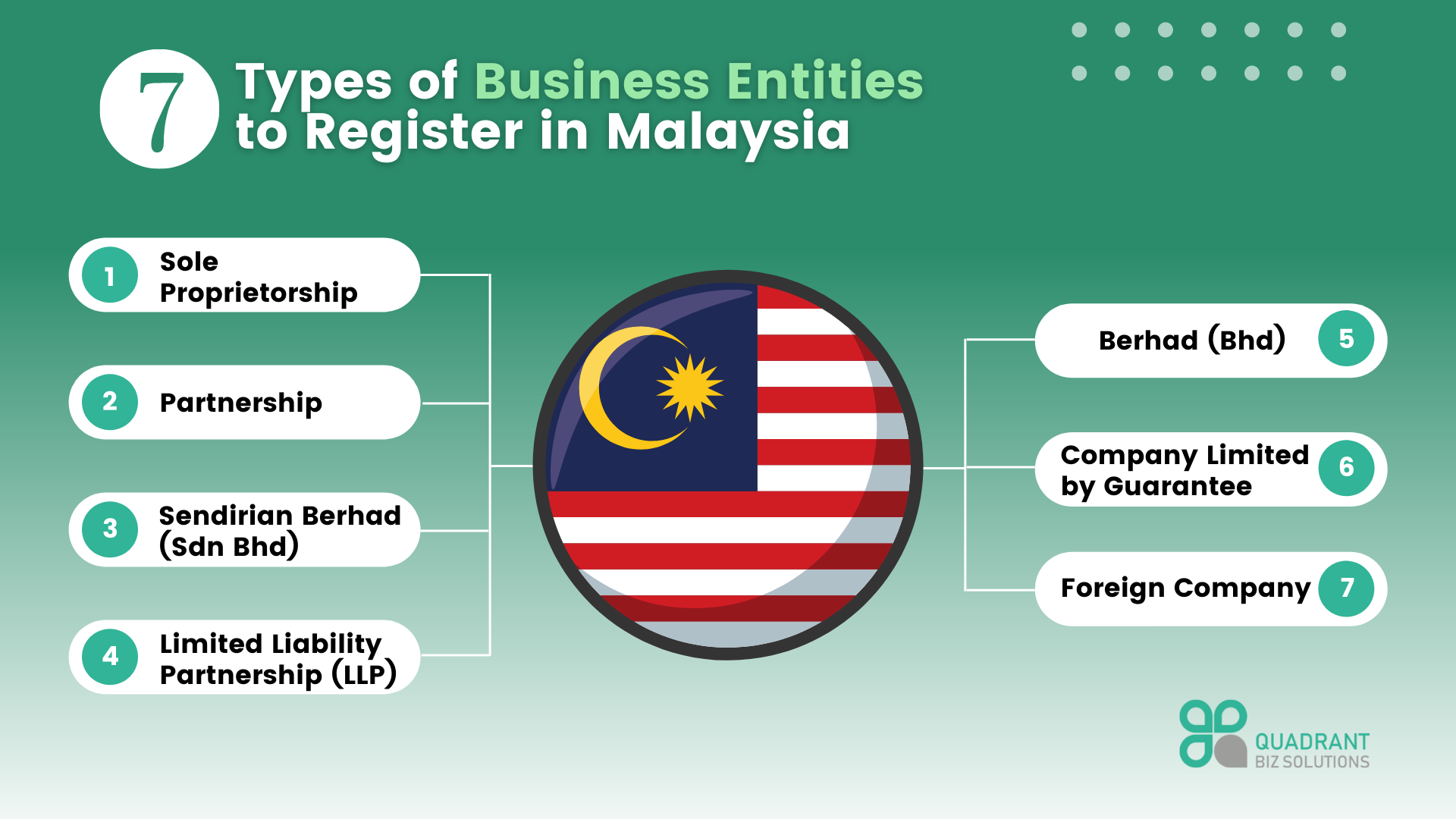

Understanding Business Entities In Malaysia Quadrant Biz Solutions

Pin On Company Registration Fees In Malaysia

Company Registration In Malaysia For Foreigner Foreign Malaysia Small Business Ideas

The Ultimate Guide To Incorporate A Company In Malaysia 2021

Malaysia Company Registration Company Registration Malaysia Foreign By Company Registration Expert Medium

The Foreigner S Guide To Private Limited Company Incorporation Foundingbird

What Are The Steps To Set Up A Malaysia Company

2021 Guide What You Should Know About Foreign Company Set Up In Malaysia

The Foreigner S Guide To Private Limited Company Incorporation Foundingbird

Company Registration Malaysia Company Malaysia Registration

6 Types Of Business Entities In Malaysia Tetra Consultants

Investor Relations Bursa Malaysia S Foreign Shareholdings

The Ultimate Guide To Incorporate A Company In Malaysia 2021

Can Foreigner Hold 100 Shares Of The Company In Malaysia

Foreign Company Registration Options In Malaysia Acclime Malaysia

Malaysia Company Registration For A Foreigner Person Or Resident